is installing a new roof tax deductible

But it can be an expensive prospect. You can find just about everything you need to know about depreciation here.

Are Roof Repairs Tax Deductible B M Roofing Colorado

A new roof comes at a substantial cost.

. Installing a new roof is considered a home improvement and home improvement costs are not deductible. Suppose your contract price was 20000. Currently one tax credit can help homeowners with their new roof costs.

Unfortunately you cannot deduct the cost of a new roof. The Non-Business Energy Property Tax Credits have been retroactively extended from 12312017 through 12312021. However installing a new roof on a commercial property or rental.

A residential roof replacement is not tax deductible because the federal government considers it to be a home improvement which is not a tax deductible expense. Most businesses qualify for this deduction but there are limitations. In summary there is no immediate deduction allowed for the cost of a new roof for a personal.

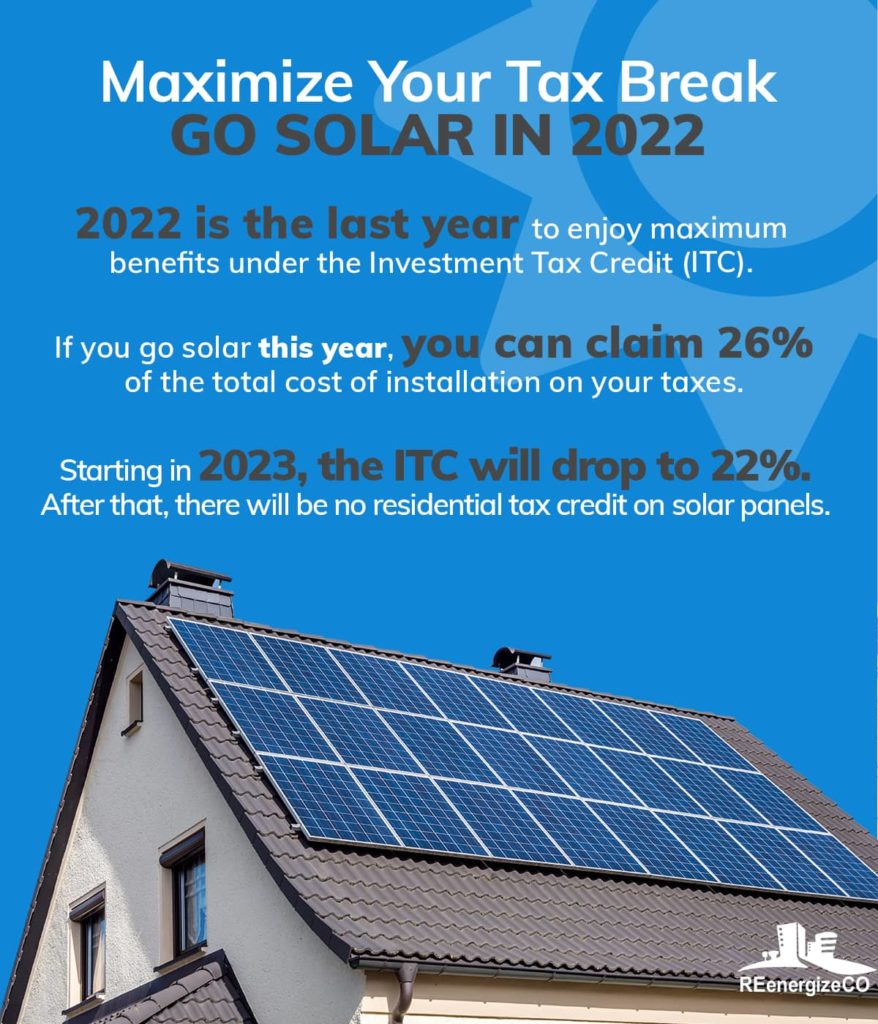

Previously it allowed homeowners a federal solar tax credit for roof replacement. 10 of cost up. Does any guidance issued for the energy credit under section 48 of.

Installing a cool metal roof to your home within that time frame through the end of 2020 will make you eligible for a 500 tax credit. Installing a new roof is considered a home improvement and home improvement costs are not deductible. Is My New Roof.

Is My New Roof. Install a solar roof to take advantage of the energy tax credit and receive a much-needed tax break. Putting on a new roof is a great investment especially if you install a cool roof.

For example if you install a new roof over your house the roofing. The credit was initially set to last through 2007 but it has been extended several times. If you run a home-based business or work from a home office then you can get tax deductions for business-related expenses.

A homes tax basis dictates the amount of taxable gain that results from a sale. Tax deductions like Section 179 grants and. UPDATED JANUARY 2021.

Is Installing A New Roof Tax Deductible. The cost of a roof installed on an owners personal residence is not deductible as an expense in the year the expense incurs but rather added on to the initial cost of the property. So if you spend 50000 replacing your roof with a reflective roof but a normal roof would cost 45000 you can only claim 5000 in the basis for your tax credit.

Most businesses qualify for this deduction but there are limitations. However youll need to obtain an important. Installing a new roof is considered a home improvement and home improvement costs are not deductible.

If your roofing contractor charged you sales tax on the entire contract amount then you can claim the sales tax paid to the contractor. For example if you purchase the home for 400000 and spend 15000 to install a new roof the homes tax. Components such as a roofs decking or rafters that serve only a roofing or structural function do not qualify for the credit.

A new roof comes at a substantial cost. Get a Tax Deductible Roof. Is Installing A New Roof Tax Deductible.

Unfortunately you cannot deduct the cost of a new roof.

Can I Claim The Federal Solar Tax Credit For Roof Replacement Costs Westfall Roofing Tampa Sarasota

Mortgage Refinance Tax Deductions Turbotax Tax Tips Videos

:max_bytes(150000):strip_icc()/GettyImages-551425607-f1c354ae6d184b89a161e714d2ef659b.jpg)

Are Home Improvements Tax Deductible

Tax Deductible Home Improvements For 2022 Budget Dumpster

Tax Code Allows Building Owners To Expense New Commercial Roof

New Detroit Repair Program Can Fix 1 000 Roofs Nearly 5 000 Applied

5 Tax Deductions When Selling A Home Did You Take Them All

New Tax Law Makes It Easier To Replace Your Commercial Roof Roberts Roofing

Can I Deduct Replacement Windows On My Taxes Conservation Construction Of Houston

How To Make A Home Insurance Claim For Roof Damage Forbes Advisor

Is Roof Replacement Tax Deductible Cap City Restoration

Do Solar Tax Credits Apply To Re Roofing Solar Installation In Florida

Seamless Gutters Tax Deduction Advantage Seamless Gutters Brainerd Mn

How Installing Solar Panels Can Help You Save On Your Taxes

Free Roof Repair Replacement Grants And Assistance

Are Home Improvements Tax Deductible Dumpsters Com

Deducting Cost Of A New Roof H R Block

Top 6 Tax Benefits Of Real Estate Investing Rocket Mortgage

Commercial Roofing Tax Benefits Kodiak Roofing Waterproofing